Every strategic decision in your firm rests on assumptions about what clients value

Which practice to grow? What services to launch? How to position for panel renewals? What to say in pitches?

Most firms guess. Then rationalise the guess with partner opinions and polite client feedback.

Asymmetric Strategic Intelligence (ASI) replaces the guess with intelligence. The kind of intelligence that has seen clients increase their pitch win rates up to 143%.

Give us 30 minutes and we'll identify whether ASI fits your situation.

The intelligence you don't have

If you're making strategic decisions based on —

- What partners think differentiates you

- What clients say in relationship conversations

- Feedback from the pitches you lost

— you don't have client intelligence; you have assumptions plus anecdotes.

When you're relying on assumptions and anecodotes, you don't know —

Who kills your proposals. It's rarely the person you pitched; it's the committee member who wasn't in the room. What criteria did they apply?

What "safe choice" means. When clients default to the bigger firm, it's not about capability. It's about defensibility. What makes you feel risky to them?

Why your message dies internally. Your contact loved the pitch, but it went to the other decision makers and never came back. What happened in that room?

What's differentiating versus just expected. You're leading with what you think matters. What if what you think distinguishes you is fifth on the client's list?

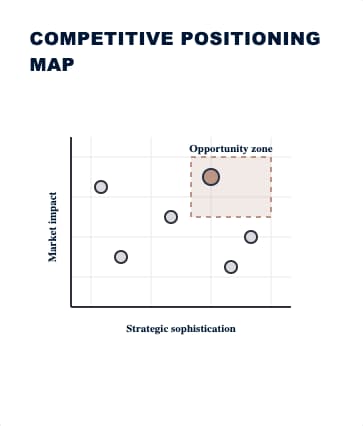

The good news is that your competitors are guessing, too.

When firms come to us

Losing pitches to "essentially similar" competitors

The feedback is always the same: strong capabilities, good credentials, but they couldn't tell you apart. You've tried better messaging. It didn't work.

Growing a practice or launching a service

Before you invest in a new practice area or service line, you need to know what the market actually values — not what partners assume the market values.

Panel renewal approaching

You need to strengthen your position before the review. But strengthen it around what? The criteria that will actually be evaluated, not the criteria you hope matter.

New leadership wanting strategic direction

New managing partner. New practice head. First 12–18 months to set direction. Base it on intelligence, not inherited assumptions.

Rebrand or repositioning

You're about to spend significant money on messaging. Do you want it based on what you think clients want to hear, or what drives their decisions?

Price pressure

You're competing on price when you shouldn't have to. That happens when buyers can't see a difference worth paying for.

All of these are the same problem: strategic decisions based on assumptions about what clients value.

What intelligence reveals that assumptions miss

Case 1: The heritage liability

Partners assumed their 1960s founding signalled stability and trust. ASI revealed their target market read "established heritage" as "old-fashioned and slow."

The capability they thought was an asset was actively closing doors.

Case 2: The invisible decision-maker

A firm kept losing at the final stage. ASI revealed the actual decision was happening two steps earlier — with someone they'd never presented to, applying criteria they'd never addressed.

They'd been optimising for the wrong conversation.

Case 3: The differentiator nobody mentioned

A firm discovered the capability they led with ranked fifth in what actually drove decisions. The capability that ranked first? Something they did but never mentioned — because they assumed everyone did it.

They were winning despite their positioning, not because of it.

Case 4: Searchlight Group — 143% win rate improvement

The situation: 35% pitch win rate. Six hours per proposal. Stuck in proposal hell.

What ASI revealed: The unstated criteria evaluation committees actually use. The positioning mistakes that trigger "safe choice" rejection. The proof points that close the gap between "qualified vendor" and "obvious choice."

The result:

- Win rate: 35% → 85% (143% improvement)

- Proposal time: 6 hours → 2 hours

- Revenue impact: $1.5M+ additional annual potential

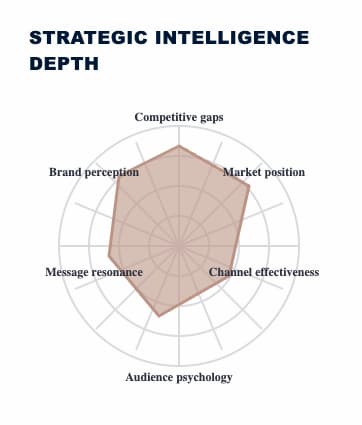

What ASI reveals

ASI shows you what clients actually value — not what they tell you, not what partners assume, but what tips their decisions when firms look similar on paper.

Who actually decides — and who kills it first

The person you pitched isn't always the person who decides. And the person who kills your proposal often isn't in the room. ASI shows you who matters and what they care about.

What gets you rejected before you compete

Some criteria aren't differentiators — they're the price of entry. Get them wrong and you're eliminated before anyone compares your capabilities. ASI shows you what you can't afford to get wrong.

What makes you different — versus what everyone claims makes them different

You're probably leading with something every competitor also claims. ASI shows you where you're genuinely different and where you're wasting breath.

What disqualifies you

The criteria that trigger rejection. Often invisible and unrelated to capability. Always operating before you know you're being evaluated.

Why your message won't survive the committee

Not whether your message "resonates". Whether it survives scrutiny when your contact has to defend choosing you.

What ASI is not

ASI is not a survey. It doesn't count buyers or estimate market size.

ASI is not prediction. It doesn't tell you what any specific client will do.

ASI is not a replacement for client relationships. The conversations you have with clients tell you about your relationship. ASI tells you about your category.

ASI shows you what's driving decisions in your category — who matters, what they care about, what gets you rejected, and where your positioning is landing versus where you think it's landing.

Why this works

Large language models encode how professionals in specific roles actually reason — not what they say in surveys, but how they think when they're accountable for decisions.

Stanford research shows 85% consistency with human reasoning patterns. The Journal of Marketing found 95% alignment with real decision data.

But the proof that matters: a professional services firm went from 35% to 85% win rate when they stopped guessing.

Read more about the methodology

"We already talk to our clients"

You do. And those conversations reveal how your relationship is going.

They don't reveal how decisions work across your category. They don't tell you what's happening in committee rooms you're not in. They don't surface the criteria your contact won't mention because they don't consciously know they're applying them.

Relationship intelligence and decision intelligence are different things. You have the first. ASI provides the second.

"Can't we just interview more clients?"

You could try. But you'll get:

- Polite feedback, not honest evaluation criteria

- Post-rationalised explanations, not actual decision drivers

- What they think you want to hear, not what they actually weigh

- Insights about your relationship, not your category

The people who rejected you won't tell you the real reason. Often, they don't consciously know it themselves.

ASI shows you what's really happening — including the parts clients can't or won't articulate.

Find out what's driving decisions in your category

Book a 30-minute discovery call. We'll explore your situation — whether that's competitive losses, practice growth, panel renewals, or strategic direction — and identify whether ASI reveals the intelligence you need.

You'll leave with clarity on whether this fits. No generic pitch — just a frank assessment of whether this methodology solves your specific problem.

Prefer to email? Email us at asi@taleist.agency.